Summary

- Rental increase past its peak

- 9.7% up year-on-year

- 11% increase in rental demand

- Supply & demand imbalance wont disappear in 2024

- +5% growth in rental values in 2024

How does 2024 look?

Over recent years the chronic imbalance between supply & demand has driven the rental prices. Effectively they have risen £3,360 a year on average over the past three years alone.

Realistically we are past the peak rental growth, and its likely to slow down significantly during 2024 in growth, mainly due to affordability issues. In some of the higher value area's we have already seen resistence in rents, effectively demonstrating those landlords overpriced.

The rental growth slowing will be mainly driven by the London market, which accounts for 30% of the rental supply throughout England, therefore will make the average figures disproportionate. Where it is also the most expensive area, it is affecting affordability significantly and has definitely reached its peak. I would expect rental growth averages to slow down now, taken the previous into account, averaging around 5%-5.5% by the end of 2024, down from the current growth of 9.7% year-on-year. It's unrealistic to see a higher growth than +2% in London in 2024, again due to affordability, which would be the lowest growth in London since 2021.

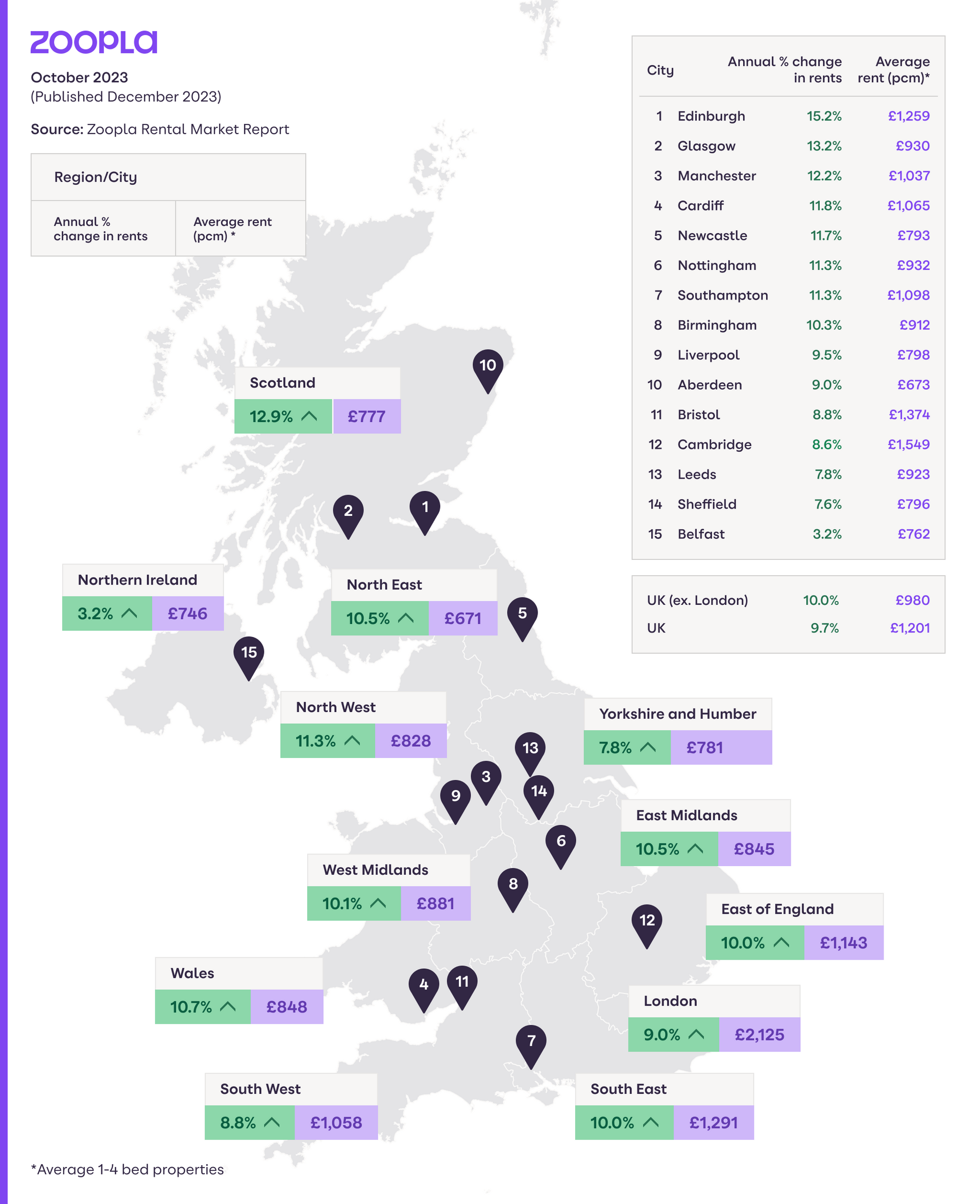

UK rental growth down to single digits

As of November 2023 the UK rental growth slowed to 9.7%, which is down from 11.9% year-on-year, however still ahead of earnings growth of 7.9% London has had the biggest rental growth slowdown, sitting at 9% compared to 17% year-on-year. Throughout the rest of the UK areas have continued to perform around 2022 levels.

Scotland have introduced rent controls, resulting in landlords and agents being unable to increase rents hover 3% a year over the duration of the tenancy. The reason I mention this, is because Scotland has performed really well from a landlord perspective, with 12.6% growth, demonstrating how rent controls can be counter-productive and distort markets.

Four factors have driven strong rental demand

There are four main factors that have driven the rental demand over the past three years specifically, listed below:

- The re-opening of the economy after pandemic restrictions were lifted from mid-2021 onwards, including a resumption of international travel

- Strength of the labour market with jobs growth and income increase boosting demand for rented homes

- Higher mortgage rates have made buying power tough. This has kept would-be buyers in rented homes and reduced available supply

- Record levels of immigration into the UK, particularly high numbers of overseas students, has boosted demand

Overview

The UK rental market has been on fire the past three years, however it is starting to cool. Realistically 2024 will continue to grow, simply due to the imbalance of supply and demand, however with rates effectively at peak levels of affordability then it is unlikely to see as high a growth through 2024.

Imbalance is likely to continue as mortgage rates are still high for some first time buyers, meaning they will be kept in rentals longer and the fact many landlords have sold on and not 'as many' new investors have hit the market yet (they are waiting for the market to suit).

As mentioned London will lead the slowdown, mainly due to affordability pressures - the average London renter spends 40% of earnings on rent alone, compared to 28% throughout the UK.

I would expect to see rental growth to continue running ahead of earnings growth in all other regional housing markets throughout 2024, potentially up to around as high as 8%, again due to the imbalance in the market and the fact there is still room to grow in the other regional markets.

With the imbalance of demand it's looking like another tough year for tenants, competing with more than 30+ competitors per property on average, however a good market for investors.

Data gained from personal knowledge, Zoopla, Onthemarket, Boomin & Home

Check out the Zoopla index below: