Summary

• Sales volumes up 12% year-on-year

• The market is on track for 1.1m sales in 2024, up 10% on last year

• Annual house price inflation stays at 0.2%, same since February 2024

• Higher mortgage rates continue to impact buying power

• Annual mortgage costs for buyers are 61% higher than 3 years ago (£4.3k average)

• 64% of the market registering price falls

• Buyers in Southern England facing greatest impact

• +32% Year-on-year growth in mortgage approvals for home purchase

• North East has no areas with annual price falls

Sales Volumes up – Price’s remain stagnant

A sustained upturn in sales agreed throughout the start of 2024, which is supporting a higher than expected sales completion for 2024 (1.1mil), however the prices have remained stagnant for the majority of UK. The market is more balanced than it has been since before the pandemic. This is positive news and means more people have a chance of moving home in 2024 - so long as sellers remain realistic on pricing - while static prices are not worsening affordability.

Sales agreed are 12% up year-onyear. The number of sales agreed has been higher than last year for the last 4 months. The housing sales pipeline is now rebuilding after a period of lower sales when mortgage rates spiked higher in 2022 and 2023. This is starting to reflect on mortgage approvals, which is also 32% up since February 2023.

Agreed sales to completions are now also at all time high in terms of average time between, sitting between 4 – 6+months, so its hard to tell at the moment for definite completions for 2024 specifically.

House price inflation stagnant

Annual house price inflation is largely unchanged since last month and stands at -0.2% at the end of March 2024.

House prices continue to fall, at a slowing rate, across five English regions covering southern England and the East Midlands. Prices are down the most (-1.7%) across East of England.

Mortgage rates remain higher than recent past

Mortgage rates spiked twice in the last two years, at the end of 2022 and over the summer of 2023, as interest rates increased to combat rising inflation. The primary impact on the housing market was a 23% drop in sales over 2023 and modest house price falls, which did very little to help reset housing affordability.

Average mortgage rates for a 5-year fix at 75% loan-to-value have fallen back to 4.5% over recent months. They have started to drift higher in recent weeks on shifting expectations for interest rates cuts later this year.

Mortgage costs for home buyers 60% higher than 2021

While base rates look to have peaked, and consumer confidence is improving, the reality is that the annual mortgage repayments for a typical buyer using a 70% LTV loan for an average priced home are still much higher than 3 years ago. This continues to act as a drag on buying power and levels of house price inflation.

Moving from sub 2% mortgage rates in March 2021 to 4.5% today, the annual mortgage repayments for a home purchase have risen by 61%, from £7,100 to £11,400 at a national level.

Increased mortgage rates hit southern England most

Following on from the previous, the annual cost of mortgage repayments for an average priced home is more than £5,000 higher per annum in 2024 than 2021 across the South West, South East and East of England. This rises to a high of an extra £7,500 in London. Across other regions and countries of the UK, the increase is lower, ranging between £2,350 and £3,900 a year.

Due to the northern markets being more affordable than the southern market, the market up north is holding better.

6/10 homes in markets registering annual price falls

The squeeze on housing affordability from higher mortgage rates, lower incomes growth and rising living costs are keeping house prices under steady downward pressure across southern England.

At a region and country level, the coverage of homes in markets with price falls is greatest across southern England where 95-100% of homes are now in local markets with annual price falls. East Midlands also has a high proportion of markets with price falls at 93%.

Across the rest of the UK, there are signs of improvement in pricing. Scotland has pockets of lower prices but at a national level prices haven’t fallen year-on-year. As the UKs most affordable region, with an average price of £142,000, the North East now has no areas with annual price falls

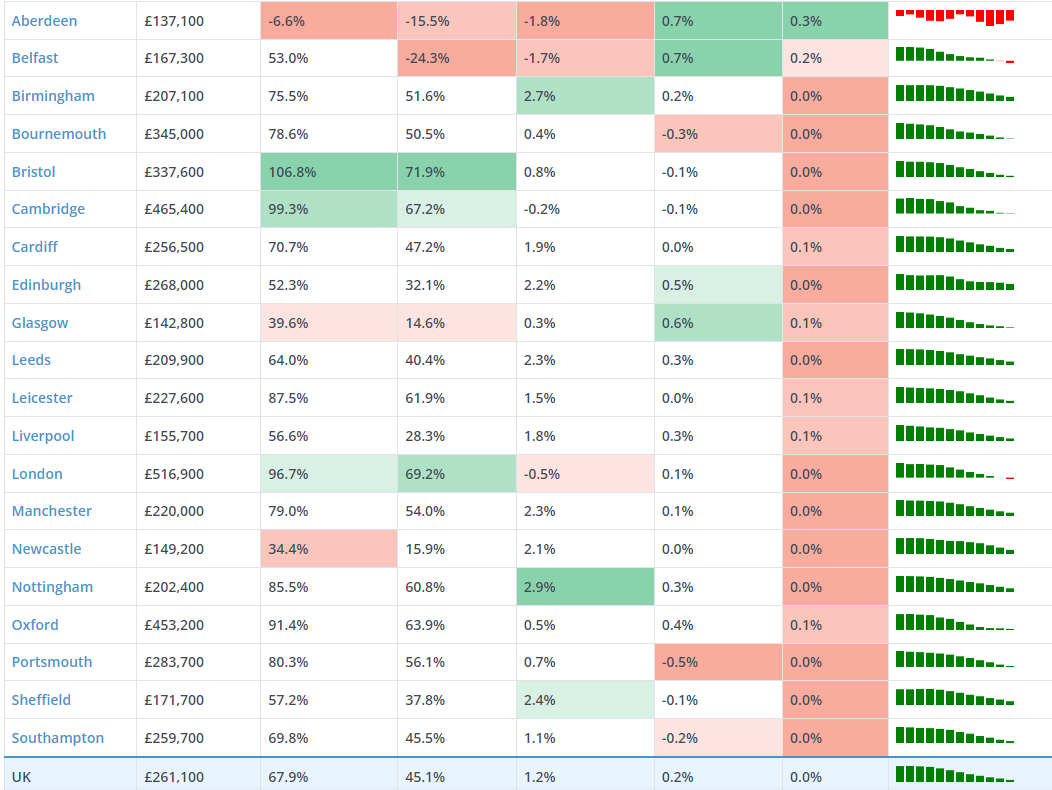

Check out the latest regional performance below:

Want to talk UK property, investment or how to start? Drop me an email to talk further

Information gathered from personal knowledge of market, rightmove, zoopla and home