For years many have wondered why can you rent at a higher price of a mortgage, but not be able to borrow a lesser mortgage amount! Well Skipton Building Society have released a product exactly for those renters, 100% mortgage. This is the first non-deposit mortgage option since the crash in 2008.

This could be a fantastic opportunity for some, however I its important to understand the potential risks when taking 100% mortgages out. There is a reason they were stopped! Lets go through it…

- This product is only available to first-time buyers who have paid their rent in full and on time for at least 12 months

- It’s a five-year fixed mortgage and works just as other mortgage deals on fixed term basis, the only difference is you don’t need a deposit for Skipton’s

- It is portable, should you wish to move home during the fixed period

This deal is solely aimed at renters who are struggling to get together a deposit, however if you do have a deposit smaller than 5% then you can still apply. Skipton have probably introduced it due to the heavily increased rents and increasing property prices together, so for you to be able to apply for one here is some of the criteria;

- Must be a first time buyer and over 21 years old

- Must have evidence of you paying 12 consecutive months in full and on time

- Must evidence 12 consecutive months of paid household bills (gas/elec, council tax, amazon prime)

- Cant have missed any other repayment commitments in the past six months

- Cannot buy a new build flat

- Maximum you can borrow is £600,000

What’s the catch?

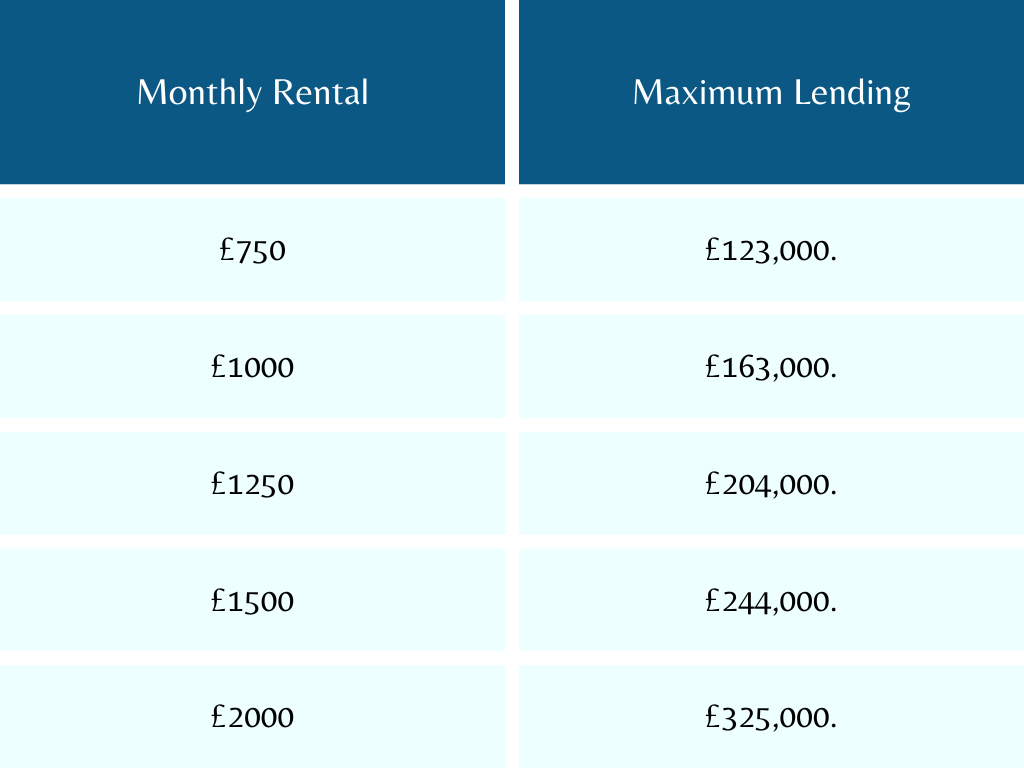

You can only borrow 4.59x your earnings or up to maximum of your current rent or less than what you pay each month. Typical mortgages let you borrow an amount based purely on your income and financial commitments.

Skipton’s 100% mortgage is not allowing you to borrow more than the rent you pay each month. In simple terms if you pay £1200 a month rent, you can only borrow a mortgage that costs at maximum £1200 a month.

* Based on a 25-year mortgage term

* Skipton's specific affordability calculations might mean you're not able to borrow as much as displayed in the table

What’s the interest rate?

It comes in at 5.49%, importantly with no fees (most deals have associated fees) on a fixed five year basis. To give you an idea of a comparable option if you had a 5% deposit then the average rate whilst writing this its 4.69% with a £350 fee, so nearly 1% higher. If you had what is seen as the average deposit of 10% then its sitting around 4.44% with £999 fee.

My thoughts on the product?

I feel it does provide a genuine opportunity (depending on where you live and the average house price) for those struggling to save with the high rental amounts. However its important to understand the real risks involved here… 100% mortgages give a genuine possibility for you to go into negative equity. If you are planning on this to be a 1-3 year plan I would say… DON’T do it. Keep it simple here, if you purchase today at £125,000, and the market drops by say 4% in the next year (which is possible) your home would be worth £120,000, leaving you in negative energy.

If you are purchasing accepting this is a minimum five year plan then you should be jumping on this (seek expert legal advice) and use it as an opportunity to get onto the property ladder. In history of UK property the longest it has taken for equity values to double is 14 years, the minimum is two years, so edging your bets as such on five years you would likely be in positive equity at the end of the five year fixed.

There is historically an 18 year cycle in the UK property market, 7 year increase in prices – then stability and balance – followed by another 7 year hike in prices – followed by a form of crash. Therefore as long as it’s a long term investment you shouldn’t go wrong.

There is also an early repayment charge on this, potentially thousands so understand what you are getting into.

The most important thing to remember here is there is no guarantees there will be 100% options available at the end of the fixed term so check out my biggest tip below!

My biggest tip…

Make overpayments! Skipton’s 100% mortgage allows you to make overpayments of up to 10% per year. You want to position yourself to have at least 10% deposit in the home at the end of the term, firstly to protect yourself should there not be any 100% options, secondly to give you far better rates. Be strict with yourself and set up a realistic overpayment plan.