Summary

• UK rental inflation slows to +6.6%

• London leads the slowdown with rents up 3.7% over last 12 months

• Rental still +2x pre-pandemic

• Supply of homes for rent up 18% but still 1/3 below pre-pandemic

• Rents have fallen in some major cities over last quarter

• Room for rental growth in most affordable areas

• Rents continue to outperform wage increases

• Supply/demand imbalance will continue

• Will politics affect the rental market?

UK rental inflation +6.6%, but lowest for 30 months

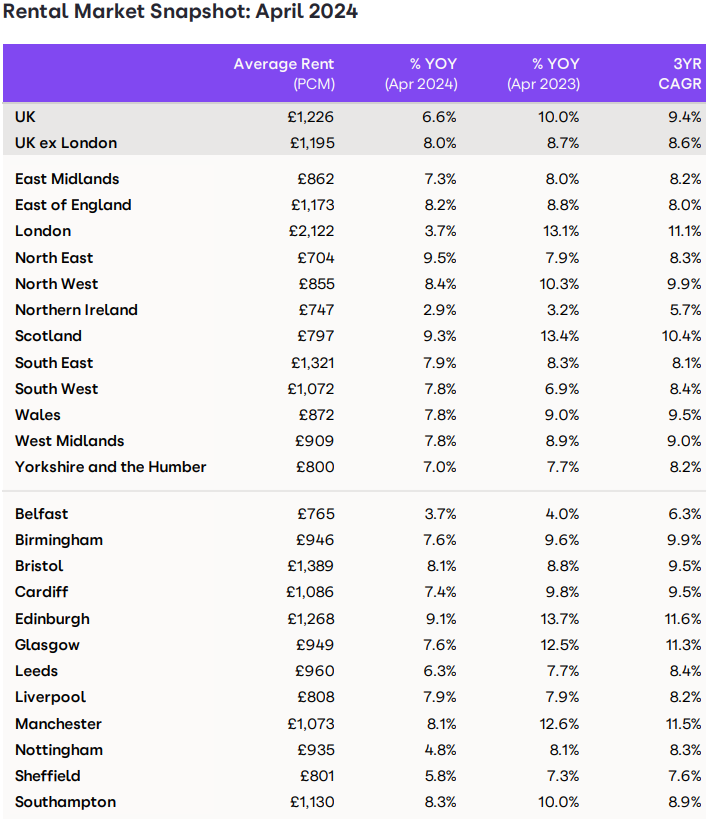

Annual rental inflation for new lets is up 6.6% as of April 2024, this is 10% lower than a year ago. The average monthly UK rent is £1,226, up £80 over the last year. This is the lowest rate of annual rental price inflation for 30 months (Oct 2021) as demand weakens, due to the sharp rise over recent years and affordability constraints continue. However, it is likely that rental inflation will continue to outperform UK inflation for the foreseeable.

Demand slows with recent increases, however supply low

The chronic imbalance between rental supply and demand is starting to get closer, however it is still vastly imbalanced, this will keep rental prices increasing, just a slower rate.

As the rental prices have increased significantly over the last three years consistently, it had to slow down. Where mortgage rates increased substantially, this kept first-time-buyers out of the market, again increasing pressure on the rental market. Rental demand is down 25% year-on-year but competition for remains high with over 15 households chasing every rental home, in some areas double this, this is more than double the pre-pandemic average of six between 2017-2020.

The average number of homes for rent per estate agent has increased by 18% year-on-year, offering a little more choice. However, the supply of homes for rent remains a third lower than the pre-pandemic period as low investment in rented homes keeps the overall stock of private rented homes broadly flat, with pressure put on landlords from the government.

Demand is down by up to 30% across the East of England, followed by London -28%, the South East -27% and Scotland -27%. The biggest increase of supply is in London at +23.

London taking biggest hit on rental inflation

London has led the slowdown way with average rents rising by just 3.7%, down from over 13% this time last year. The average growth in rents across the rest of the UK, outside of London, is currently 8%. The highest increases in rents are being recorded in the North East (9.5%) and Scotland (9.3%).

In London, the underlying rate of rental inflation -1.3% as average rents have fallen by 0.3% over the last 3 months.

Rent & Earning increases becoming closer

Rents have been rising faster than average earnings for over 2.5 years, since October 2021. With rental inflation slowing, the gap to earnings growth, currently at 6%, is starting to narrow.

The driving factor, obviously being the inability to afford the increases consistently outweighing earning improvements. However, rent levels will continue to be in strong demand, due to low levels of new investment in private rented housing. It’s likely the more affordable areas will continue to heavily outweigh earning increases.

As a country, the proportion of gross earnings spent on rent is the highest for a decade. The steep rise in rents over the last 3 years has worsened rental affordability.

It is not surprising that rents are currently rising fastest in the North of England and Scotland where rental costs account for the lowest proportion of gross earnings. In contrast, London has the highest rents which account for a higher proportion of average earnings – these are now back to 2015 levels having fallen over the pandemic.

Supply & Demand imbalance will continue

It’s likely that the rental supply and demand will improve materially over the next 12 months, however will stay imbalanced. Levels of new investment in the private rented sector remain low, with external pressures from the government making it less appealing, while demand is set to remain above-average. This means rents will continue to increase at a slowing rate.

Private landlords continuing to sell

2016 tax changes rapidly slowed new investment by private landlords. Data on changes in the number of outstanding buy-to-let mortgages shows rapid growth until 2016 followed by much lower levels of new investment until 2022 when the stock of buy-to-let mortgages started to decline as interest rates increased.

Date shows private landlords selling at a continued steady rate. Two-fifths of homes over the last 4 years seem to be private rentals.

Current trends are expected to continue with low new investment by private landlords meaning the stock of rented homes will remain unbalanced between supply & demand. Corporate landlords will continue to invest but it will take some years for this group to grow ownership levels enough to impact on supply at a macro level.

There are also concerns over what further pressures the government will put on the private landlord sector, if further pressure is applied then this would in turn affect the rental market also, continuing to increase prices.

Politics & Outlook!

The rental inflation is likely to continue to drop throughout 2024, as its not sustainable to continue at the previous growth, meaning a slowdown was inevitable , likely around the 5% region.

On the politics front, the Rental Reform Bill failed to make it onto the statute books, it seems likely that rental reform will return in the next parliament whichever party forms the next Government.

While changing the protections for existing renters is important, the greatest importance is to boost the stock of homes for rent – both private and affordable through greater housing delivery, whilst in my opinion encouraging investors back to the market at mass.

Only by boosting supply there can be an improvement on choice for renters, with this you can then apply pressure to increase the quality of housing.

While there has been more political focus on the challenges facing the private rented sector, progress will only happen with whichever setting out specific plans and goals for the future of the private rented sector in manifestos. A healthy private rented sector is vital for economic growth and a more balanced housing market.

Check out the latest statistics below from Zoopla:

Want to work with Charlie?

Charlie is an inspirational speaker, property expert and business scaling expert