Key Points

· 12.1% increase in rental values over the last 12 months. This is more than double of earnings at 6%

· Demand is 46% above average while supply is 38% lower

· Affordability for a single renter is at its highest in over a decade at 35% of average weekly earnings

· Demand on one-bedroom flats has seen its highest demand in ten years as renters are seeking better value

· Rental affordability will start to hit the increase in rent prices in first half of 2023

· Rent growth likely to slow to maximum 5% by end of 2023

· 75% of renters have only increased by 3.8% compared to the moving market

Supply/demand imbalance at highest level

The rental market continues to face a chronic imbalance between supply and demand. With mortgage rates rising, this pushes more pressure on demand as home ownership for first time buyers is limited due to new affordability measures. Rental enquiries per estate agency branch are 46% above the 5-year average. However, the stock of homes for rent remains 38% below the 5-year average and 4% below November 2021.

No sign of rent inflation slowing in the short term

With there being a chronic shortage in terms of supply & demand, its unlikely that rent inflation will slow down in the short term. We expect to see continued growth.

For the 75% of renters that do not move each year, rental increases are much lower at 3.8% in the year to October 2022 1 - slower than the growth in average earnings. The chart compares the rental inflation rate for new lettings versus all private rented homes based on the ONS Index of Private Housing Rental Prices. This variance is why more renters are staying put, to avoid higher rental payments when they move, and further compounding supply problems.

Big cities register the highest levels of rental inflation

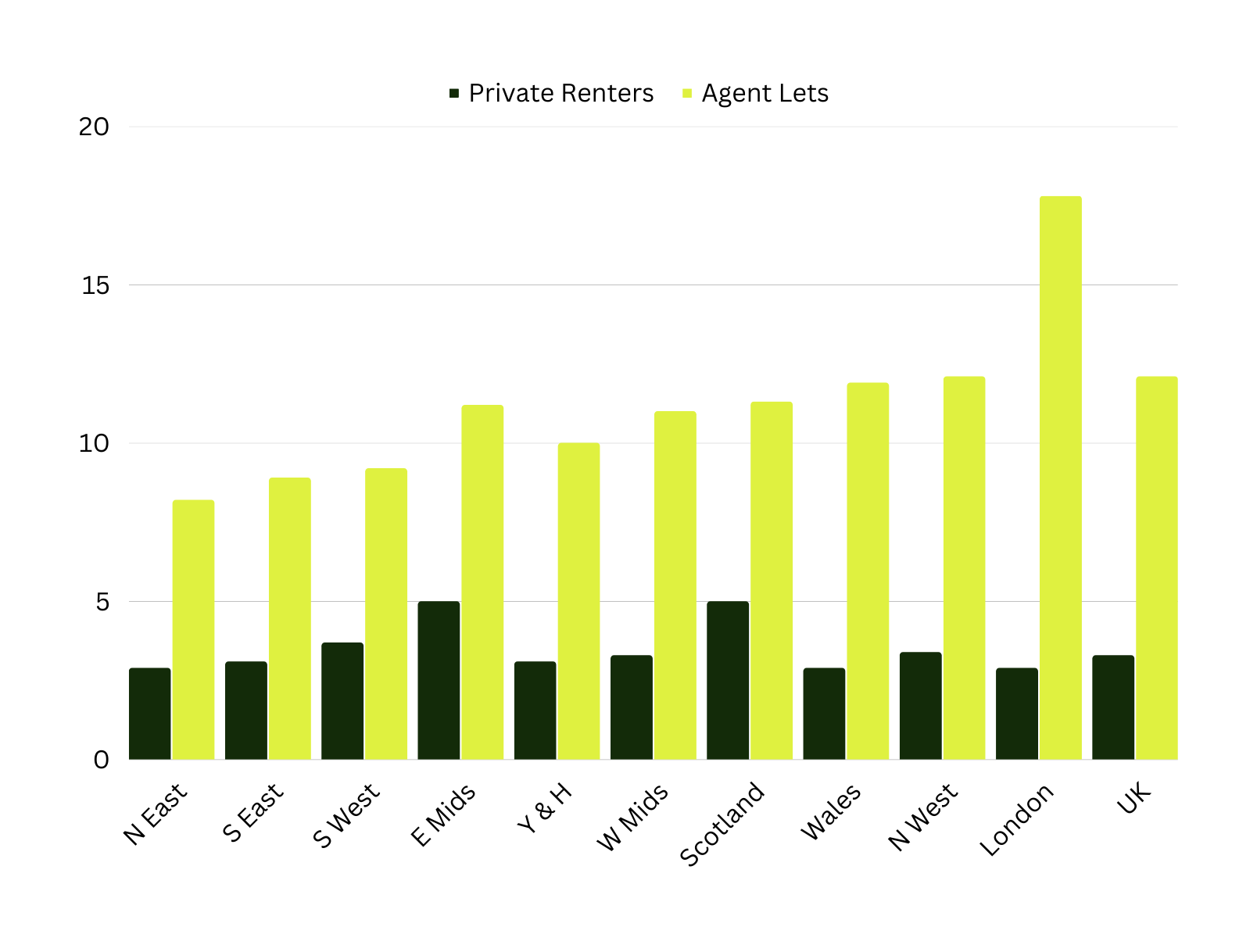

Rents are increasing fastest in the largest UK cities, led by London where rents are up 17% or £273 per month over the last 12 months. I have included a graph to give a view on other cities with great increases month-on-month. Not all cities are registering rapid gains, with Hull, York, Oxford and Leicester recording slower growth of less than 8%.

When will rental inflation stop?

The only way to slow down rental inflation is to increase the supply of properties, however this hasn’t happened since 2016, with the average staying at 5.5 million homes. Over the last few years, we have seen taxes and new legalities push landlords to ‘re-think’ there portfolios, meaning many have taken the opportunity to use a good selling market to re-structure there portfolios and downsize it, this will of course put further pressure on rental prices. Not only this, mortgages for buy-to-lets have recently changed the calculation for lending criteria, again pushing rental inflation up to support landlords affording this. Proposed regulations and new rules on renting homes that are not at an Energy Efficiency rating of C or better from 2025 are likely to result in more private landlords selling up homes that are expensive to manage and retrofit. This will offset the impact of new investment. There is a chance that if the sales market relaxes this year we could see a slight increase in supply, which will help with the chronic supply & demand situation as landlords looking to sell homes may now continue to rent them out while uncertainty in the wider sales market lasts.

Outlook

The rental market plays a key role in the UK housing market. A prolonged period of lower new investment in rented homes by landlords, together with a rationalisation of landlord portfolios, has seen the growth in rental supply stall over recent years. When there is increased demand against a lack of supply it pushes rents higher adding to affordability pressures for renters. This means more renters are having to consider a greater set of compromises when looking to secure a home. Policymakers need to understand the rental market as well as the forces and factors shaping the overall availability of supply, not simply put more constraints onto landlords, as we can document over recent years this has only put more pressure on the lack of supply. The demand for rented homes is only going to rise in the medium term, so it's important we encourage more supply from all forms of landlords, whether private individuals or large corporates. It is important that policymakers encourage good landlords of all types and sizes to stay in the market and deliver much-needed supply, therefore rethinking some of the new policies brought in is needed urgently. Only by increasing investment in the private rented sector can we ease the affordability pressures on renters in the medium term and make for a more sustainable rental market.